Is it tough love, or should you be helping your adult children get into the property market, buy a car, start an investment portfolio, or pay for a wedding?

It is perfectly natural to want to help, but does this mean you should? You need to firstly consider the impact to your own financial situation, as well as whether your kids have the financial discipline to use your support wisely. Let’s consider both of these points

1 – Set yourself up first:

It’s preferable to be financially secure yourself before you help your adult children, after all, you don’t want to end up being a financial burden to them later. And that of course is exactly what your financial adviser is helping you with.

It’s a hard truth, but you also need to consider your marital situation before you start gifting, along with the intended recipient’s marital situation. If you give away significant sums and then divorce, you risk being left with insufficient assets to fund your own retirement. Likewise, if you gift to your child, and they divorce, a portion of those funds may leave the family group.

2 – A check-up from the neck up:

Before you do gift or go guarantor, ensure the kids are sufficiently financially responsible. Without money management skills, whatever gifts you may give, including final inheritances, could be poorly utilised, if not entirely squandered.

A great place to start is by role modelling good financial discipline, after all, you most likely didn’t get to where you are by waiting for handouts or buying every shiny object you came across. If it is too late because the kids have already moved out, or because you, may not be the best role model, then how about the gift of professional personal advice. With Christmas upon us, why not consider giving them a pre-paid planning session with a financial adviser.

So, should you help?

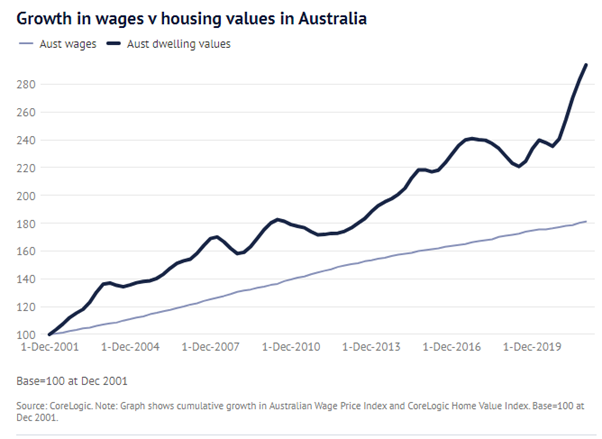

Despite all the ‘back in my day’ stories, there is certainly an argument for giving the kids a leg up when it comes to entering the property market. For decades now, wages have not kept pace with house prices, exacerbated by rapidly rising rent, making it even harder for new starters to save a deposit and cover property transaction costs.

If you are helping, there are a few things you need to clarify in advance to avoid your good intentions resulting in family money disputes later.

1 – Who are you going to help?

Are you going to help each child equally, or are some more in need of help than others? Whatever you decide, there is a real chance that someone will not be happy so it’s important to have the hard conversations upfront.

2 – What is the money for?

Are you going to be prescriptive what the assistance is for? If so, and we suggest in most instances you should be, be clear with your intentions upfront.

3 – Is it a loan or a gift?

Again, it is a matter of being clear upfront and documenting it in writing to avoid potential issues later. One point to consider if you are lending them money for a house deposit, is that it will need to be declared as a loan to the lender financing the balance of the home purchase and consequently could impact serviceability for loan approval.

4 – How are you going to help?

- Gradually, such as via a periodic cash injection. It is, however, important to avoid creating dependency on you so again ensure upfront clarity regarding the purpose and duration of your support.

- Co-contribute, a well proven method to encourage budgeting and savings habits. Here, at agreed intervals or savings milestones, you assist by matching their own savings with contributions from you. A word to the wise though – always set an upper limit otherwise you may find yourself giving far more than you intended, or can afford, to an enterprising child!

- Going guarantor by being listed on the mortgage for security or serviceability. Caution is required here, and we generally wouldn’t recommend it. There are better options so please seek professional advice if you are considering this.

- Gifting entire assets is also an option, although not really keeping with the ‘gradual approach’. Giving the kids a portion of their inheritance while you are still alive is not uncommon, but in keeping with earlier comments it is important to not give so much as to leave you financially exposed, and there may be tax and social security considerations as well. Estate planning is arguably the crux of financial planning and a core competence of our advisers.

Helping is great, and as detailed in the many articles about property affordability, for many kids is increasingly essential if they are to enter the property market. The key is to do it well – in a manner that protects you and advances the financial position of your child in a risk considered manner. As always please consult with your adviser before you put anything in place.